A deep-dive into how the top UK universities successfully attract Chinese applicants in a competitive global marketplace.

Recruiting Chinese students for UK Universities continues to be a highly competitive activity and the next year doesn’t look like it will be getting any simpler.

Competition from Chinese Universities, politics over visas, and economic slowdown in China are all creating competition, and yet UK Universities are still uniquely placed to attract the best students.

This guide walks through the essentials of a Chinese student recruitment strategy, and how your institution can carve out a unique position amongst UK universities and in the wider global education marketplace.

Contents

The Backdrop Of Global Pressures

The UK offers many options for Chinese students wanting to study overseas. With more than 150,000 Chinese students in the UK in 2022, the UK is the 2nd most popular destination by volume.

Despite the recent decline in enrolment caused by the pandemic, overseas student enrolment is quickly regaining momentum while global conditions improve.

After a low point in 2020, applications to UK universities are bouncing back fast, with around a 1/3 rise going into 2023. Data from Baidu shows the fastest increase in search volumes for UK institutions, again up by over 30% going into 2023.

So we can expect strong ongoing demand in 2024.

UK Universities mustn’t forget that they compete in a global market, not just a national one, and while the UK is still a top choice for overseas study, Chinese universities are catching up fast and we need to provide compelling reasons for Chinese students to choose us.

In addition, Australia and Canada are becoming increasingly popular for Chinese students, with strong business ties, and a perceived high quality of living without the political tension that’s felt in the US.

The Chinese Student Recruitment Funnel

Recruiting Chinese students follows a similar path to other international student recruitment, in theory.

The practice is very different.

Differences in the platforms available to communicate with prospects, and the cultural and language barriers mean there’s very little of your western marketing that can transfer into China. This means that to succeed, you need specialist skills.

Let’s look at each step of the funnel and how it needs to adapt

Top of Funnel – Awareness

Universities face their greatest challenges when it comes to connecting with Chinese students for the first time.

China’s social media platforms and advertising outlets are a unique ecosystem that’s evolving faster than in the west.

As well as new specialist platforms arriving every couple of years, existing platforms shift audiences all the time and niche platforms often shift into the mainstream.

Mid-Funnel – Consideration and comparison

This is where a weak strategy can let down a big marketing budget.

The criteria that Chinese students use to select a university aren’t always obvious.

Their parents might focus on rankings and job opportunities, but the students themselves are just as interested in safety, having an environment that’s not completely alien to them, and access to travel to the rest of UK and Europe.

At this stage, your prospective students aren’t just thinking about the university, but also about the faculty and the course. It’s really important for faculties with courses that Chinese students are interested in, to have some presence.

At this step, some 1:1 interactions will start and having staff able to respond to pre-application queries is a big step forward.

Bottom of Funnel – Support for applications

While all universities want more direct applications, not all of them have the support that Chinese sales agents can offer.

The very best agents act as concierge services for travel and accommodation, as well as the application process.

Post-Enrolment – Making sure your offer gets accepted

Support needs to go on well after the application stage to make sure that offers get accepted and acted on, so carrying on content that supports the decision and the student’s preparation to attend your university is a differentiator here.

Let’s go back to the top of the funnel and make sure we know how each step works…

Chinese acquisition channels

Almost none of the major platforms we are familiar with exist in China. There’s no Google, Meta, or Twitter, and instead there’s an ecosystem that’s built much more heavily around mobile and social.

Paid Marketing Channels

Offline ads in China (including print PR) require substantial investment and, if not effectively executed, can lead to a lot of spending with little results. The trick is not to apply Western PR and offline thinking to the China market. For instance, even with offline marketing, almost all roads lead to WeChat. The rules and expectations in the Chinese market are truly unique and understanding them is paramount in succeeding.

Pay-per-click (PPC) and display strategies serve as effective tools for customer outreach, by leveraging well-defined buyer personas to pinpoint your customer’s preferred online portals/networks, guiding your decisions on where to concentrate your efforts. It’s also important to note that Chinese tracking methods often interact poorly with Western systems (for example, don’t expect to use Google Analytics for tracking). It is best to localise whenever you can.

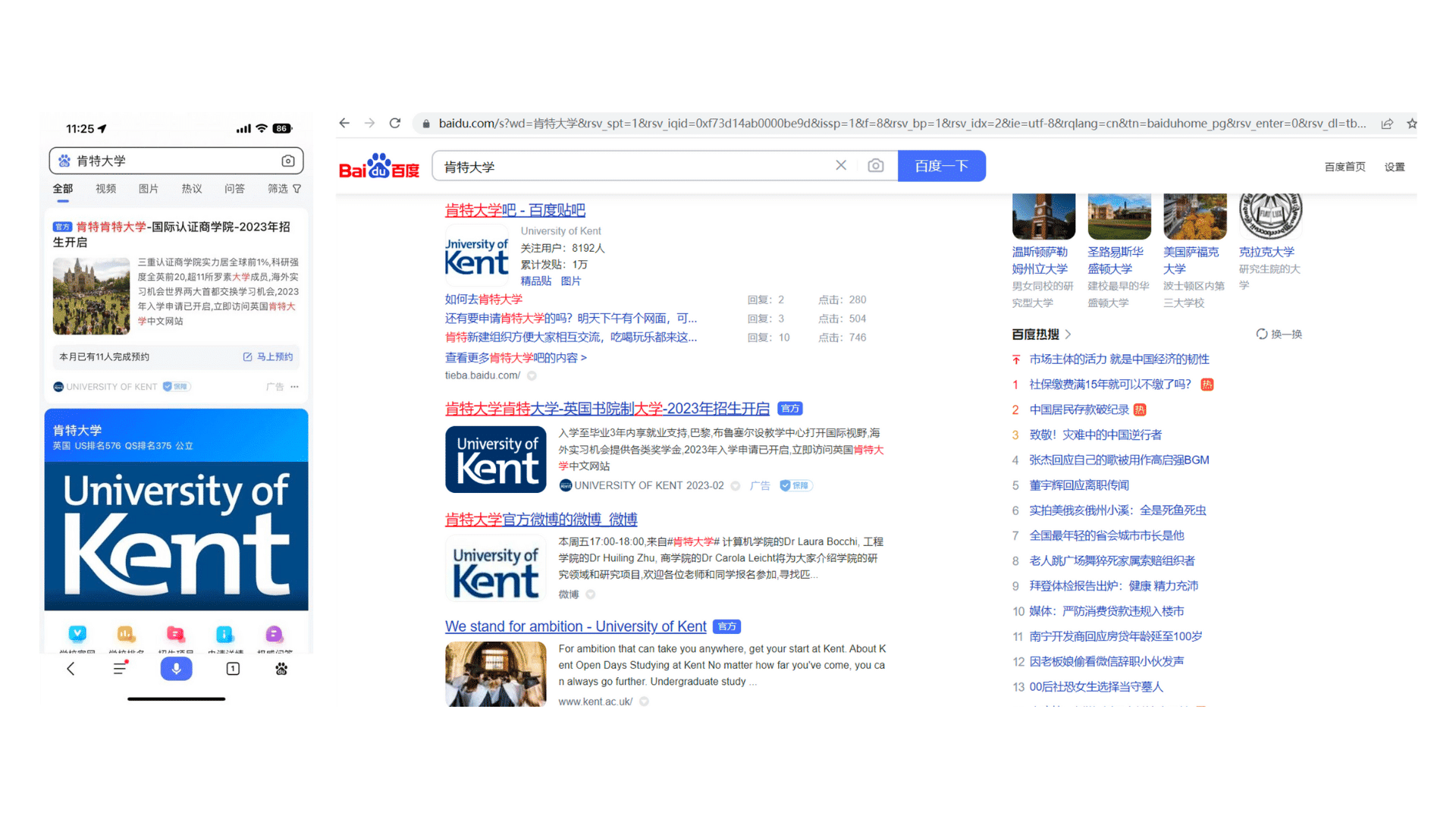

For PPC in China, brands often start their journey on Baidu, which has a 70% share of the “traditional” search engine market.

There are many similarities between Baidu Ads and Google Ads, but also some key differences.

Baidu ads are more widely accepted than Google, which could account for Baidu’s average 1% click-through rate (CTR) compared to Google Ad’s average CTR of 0.2%.

Baidu is unrivalled for the variety of marketing tools available, and its own properties dominate the search results.

Because of the vast consumer base in China, traffic numbers can be immense, so funnelling and qualifying leads is crucial in lead generation campaigns.

The University of Kent employed Baidu PPC campaigns for undergraduate and postgraduate programs.

Desktop and mobile have very different results.

Changes in search behaviour

Traditional search engines are still important, but Chinese consumers search differently now.

Gone are the days when Baidu was the one-stop-shop for search. Now, 70% of Chinese netizens use at least three platforms for search every single day.

“Social search” is the new search trend in China. Three of the biggest players are WeChat, Douyin and Little Red Book. With the rapid pace of change, keeping up with evolving China search behaviour has never been more important. It’s a sector that’s redefining China’s digital marketing for Western brands.

Chinese social media platforms, and especially short-form video platforms, have overtaken mainstream search.

77% of users prefer content-based platforms over traditional search engines. 63% also search on different platforms depending on their purpose.

Chinese social media search results are in line with what users expect.

For social search, 73% of users think it’s all about being relevant. User-generated content means the results are more relevant, authentic, and community-driven. It’s not all about hard-selling.

If you want a search experience that’s entertaining and full of depth, social media is the way to go.

Chinese students want more than just official content from the brand – they want real stories from current students and alumni, and helpful advice from influencers.

Brands are moving away from traditional search ads and putting their money on in-app ads to connect with social-savvy Chinese consumers. Rather than one-sided communication, effective China digital strategies prioritize engaging users with timely and personalized content that offers genuine value.

Paid social media ads

In China, there are numerous avenues for buying media.

Paid social advertising such as WeChat & Weibo ads are used much more frequently than in Western countries.

Social channels in China are a must-have, not an add-on.

WeChat in particular is a channel that Chinese consumers expect ahead of an email address or a phone number.

Apps in China offer sophisticated targeting and analytical features, and precise audience targeting. Companies can choose from banner ads, video ads, HTML5 landing pages, opening page ads, and even overseas campaigns.

The cost of social ads will vary wildly depending on the location and the size of your target audience, the time of year and the platform. For certain sectors, such as overseas property, there are also added regulations in place.

Platforms such as WeChat also improve the level of consumer engagement by limiting the number of social ads users receive. Great news for brands, but it booking ad space needs much more planning.

Paid social ads, whether it is boosting content on Little Red Book or Weibo, or banner and moments (discovery page) ads on apps such as WeChat, will benefit any planned social campaigns. They are a great addition to UGC campaigns, influencer collaborations, or sales-driving activations.

Paid social media KOLs

Another hugely popular form of social advertising is through Key-Opinion-Leaders (KOLs). Key-Opinion-Consumers (KOCs) or micro-influencers can also work wonders. Over the last 2 years the Emerging Comms team has had more and more success using KOCs.

KOL campaigns have a huge impact. They can either launch a brand’s success or throw it into crisis.

There are so many elements at play for a successful KOL campaign, yet many brands treat these collaborations as simple media-buy activations. Some otherwise well-honed brands have also fallen into the trap of working with KOLs without due diligence.

Launching campaigns with the wrong influencer can lead to underwhelming, or even negative campaign results.

In conversations with country managers or marketing directors, the dominant marketing challenge they express is convincing budget holders in Europe or the US that KOL marketing differs significantly from influencer marketing.

There’s a crucial need to redefine expectations of working approaches and budgets.

Premium KOLs are less like individual content creators and more like independent media houses.

They have booking managers, content creators, designers, editors, community managers, and interns, all on the payroll.

Chinese platforms themselves demand payment from KOLs who publish advertising content, further driving up the price.

KOL collaborations can suit all kinds of brand objectives beyond product promotion, to areas like student recruitment in the education sector.

Case Study: University of Surrey KOL Video Campaign

Our KOL gives the viewer a chance to walk through University life with elements that are familiar to Chinese students”

Livestreams:

The pandemic sped up the adoption of live streaming as more and more people turned to online platforms for entertainment and engagement. Now it’s become one of the primary methods of communication to engage Chinese audiences.

With over 200 live streaming platforms focusing on different markets and viewers, live streaming can function as a powerful marketing tool at an extremely low cost.

The appeal of live streaming stems from its ability to create an immediate, live connection between the broadcasters and the audience. This real-time feature holds immense value as it enables prospective consumers to engage directly with the host and gain instant and personalised responses to their questions.

Going beyond a simple question-and-answer session but offering a dynamic platform for viewers to see more of the showcased products or services helps the effectiveness of the effort.

By facilitating genuine, interactive experiences, live streaming creates an environment where audiences can form opinions and make confident purchasing decisions, ultimately boosting the persuasiveness and effectiveness of marketing activities.

Using KOLs or KOCs in livestream increases the effectiveness of reviews and brand recommendations, which increase exposure and brand recognition by the mere feature of these influencers.

While product promotion is the most popular content format forlive streams, they aren’t limited to just selling. We’ve used KOL-collaborated live streams to encourage students to decide between universities.

These partnerships leverage existing follower bases and add an extra layer of authenticity to university endorsements.

Chinese audiences appreciate real-time interactions and personalised experiences. Live streaming allows for immediate feedback, fostering a sense of community and trust between hosts and viewers.

Livestreams also provide rich data, and analysing engagement metrics gives valuable feedback to improve in the future. Analytics can help gain a better understanding of the viewer demographic, duration of viewership and interaction levels throughout the live stream.

Example: University of Dundee livestream in collaboration with KOL

For instance, take the University of Dundee’s innovative approach to student recruitment through a livestream collaboration with a prominent KOL.

The University of Dundee, known for its expertise in law and medicine, aimed to improve brand recognition and attract more students in a tough recruitment landscape.

The university wanted to boost brand visibility and engage with Chinese students by highlighting its unique strengths and standing out in a tough market.

During the critical student recruitment season, Emerging Comms crafted a livestream campaign in collaboration with an influential KOL, who added authenticity and promoted the University’s USPs from their unique perspective.

The team meticulously planned the entire process, from asset creation, scripting, and pre-promotion to on-site management and execution, to ensure an end-to-end solution to maximize brand awareness and real-time communication with student prospects.

In addition, the university could re-use the video-used as evergreen content for future campaigns.

Organic social media

China’s social media landscape is vast and constantly changing, which isn’t surprising as Chinese consumers have an average of 9 social media accounts.

For businesses looking to engage with Chinese audiences, certain platforms are a staple for a broad range of social media users.

Here’s a rundown of some of the more popular ones:

Douyin:

The Chinese version of TikTok is the leading specialist Short Video/ Live streaming platform in China (out of over 300 live-streaming apps available) also increasingly used for ‘1-click’ social commerce.

Originally favoured for comedy content and viral challenges, now increasingly used for brand discovery across fashion, beauty, food, and increasingly niche sectors, self-development content as well as KOL and celebrity engagement.

It boasts over 715 million monthly active users and 400 million daily search volume. Users typically have higher spending power with plenty of innovative Chinese Gen Z on the platform.

Universities can leverage Douyin to contribute to student recruitment within the education sectors, to showcase campus, life, events, student activities, academic programmes and other points of differentiation.

Douyin offers several advertising opportunities:

Brand takeovers: brands can display full-screen ads appearing when users open the app. These ads are highly visible, providing excellent brand exposure – and often include images, GIFs or short videos.

In-feed adverts: these ads appear in the user’s main video feed as they scroll through the app. They can be either images or videos and blend well with organic content. However, these ads will have a “sponsored” label, to distinguish them from regular user-generated content.

Search adverts: the top position on the search results page prominently showcases brand information with features like brand topics, links, brand accounts and product showcases.

Branded effects: brands can create their own specially designed effects, letting Chinese consumers apply these effects and filters to their own videos. This fun feature promotes brand awareness and active user-led interaction.

To showcase its Business School and Computer Science courses, University of Kent employed four sets of narrative-driven videos on Douyin.

We targeted undergraduate and postgraduate prospects from with different USP’s.

Watch the video to see an example of the Douyin ads with the in-app landing page and enquiry form.

Bilibili:

This video and gaming site started as a place for anime fans to share and enjoy video and vlog content.

It’s grown to include a community of over 1 million content creators and professional content from a range of genres. Famous for their ‘bullet style’ comment screens, they are a favourite among Gen-Z, as well as overseas student influencers.

Bilibili actively cultivates uploaders and professional user-generated content, an approach that’s built the platform a loyal and active fanbase.

Similar to how the COVID-19 pandemic upended in-person education in the United States, it also forced Chinese students to turn to online platforms to engage with education-related content.

Bilibili, as a long-form video platform, became a more natural home for education-focused content creators.

Bilibili Example: University of Surrey.

The University of Surrey faced challenges in gaining visibility among Chinese students amidst the Covid-19 pandemic and resulting travel restrictions.

To engage this audience, it’s crucial to spotlight the university and student lifestyle through social media videos.

It forged a collaboration with renowned UK-based KOL to establish brand credibility and showcase the university’s unique selling points through Bilibili, Weibo and WeChat.

This collaboration resulted in two videos narrating the brand story and highlighting the premium lifestyle offerings to high-net-worth Chinese consumers. The videos showed off the state-of-the-art campus and the exceptional Hospitality program through the perspective of a KOL.

University of Surrey showed off their state-of-the-art campus and the Hospitaility progam through the eyes of a KOL on Bilibili

WeChat:

WeChat is a multifunctional social media and messaging app. At its most basic level, it looks a bit like WhatsApp, but it has an entire ecosystem of other functions that makes it far more sophisticated than anything in the West.

Initially launched as a messaging app, WeChat has evolved into an all-encompassing platform offering various services, including messaging, social networking, mobile payments, gaming, shopping, travel and more.

Personal WeChat accounts aren’t intended for company use; instead, WeChat has “official accounts” specifically for this purpose.

There are two types of WeChat official accounts.

Subscription accounts focus on regular information sharing. They allow the owner to push once daily with up to 8 articles.

Service accounts cater to customer service and e-commerce, allowing four monthly pushes with 8 articles each. They also allow personalised content through CRMs, although with a more intrusive impact on users’ WeChat accounts.

Over 20 million WeChat Official Accounts exist, with 80% of WeChat users following at least one Official Account. 40% of all WeChat users spend over 30 minutes per day reading articles from Official Accounts.

These percentages are higher in Tier 1 cities than in the rest of China.

Articles contain HTML similar to miniature web pages, but with restrictions imposed by WeChat. These articles can adopt simple text and image formats or elevate their design to captivate the Chinese audience, aiming to distinguish themselves amidst the media saturation.

Brands can achieve WeChat verification using either a mainland Chinese business license or an overseas business license, though the procedures and outcomes differ.

WeChat limits overseas accounts to create Service Accounts, while Subscription accounts require a Chinese business license for verification.

To get round this restriction, some opt for third-party agents to set up accounts and overcome this hurdle.

WeChat Channels (Video Channels):

WeChat Channels offer both short and long-form image and video content. At a surface level, it’s similar to platforms already used internationally and by Chinese social media users such as Douyin and TikTok.

What sets it apart, however, is full integration within the powerful WeChat ecosystem.

WeChat Channels feature four unique video-based feeds based on a user’s followed accounts, friends’ liked content, trending videos and geo-localised content. It has the power to connect individual consumers, user-generated content and brands like never before.

“Social recommendations” account for over 50% of WeChat’s discoverability algorithm. Brands building a chain of social relationships (via Moments, Shares, Likes and Group Chat interactions) are likely to do extremely well on WeChat Channels. It’s all about high-quality content that genuinely resonates with Chinese consumers.

With videos from official accounts no longer exclusively accessible by friends and followers, it’s opened a direct pathway to WeChat’s 1.2 billion (and growing) users.

WeChat Moments ads: sitting among user-generated posts, these ads are particularly well-suited to lead-gen campaigns (i.e. collecting data on users viewing and interacting with your adverts).

WeChat Video Channels ads: one of WeChat’s newest ad types, designed for brand awareness and engagement, as well as lead-gen campaigns.

WeChat Search ads: with over 800 million monthly active users, it’s a great way to target large audiences, fast. Bidding is based on generic as well as brand-specific keywords.

EU Business School used WeChat Paid ads to raise brand awareness and showcase its program portfolio. Wechat allows them to engage potential students and motivate them to start the application process.

Across an eight-week period, the WeChat ads generated 100,000+ clicks and hundreds of leads for EU Business School.

Little Red Book (LRB):

If there’s one social media platform for targeting Chinese Gen Z and Millennial audiences, it’s Little Red Book. It has 200 million monthly active users (70% of which are female) and 300 million daily search volume.

With a unique algorithm providing engaging and up-to-date content, Little Red Book fosters shorter buying and conversion journeys.

Instead of the traditional journey moving from attention and interest, before search, action and sharing, Little Red Book pushes users straight from consideration to action and sharing.

To leverage Little Red Book in your Chinese strategy, content is king.

The algorithm promotes high-quality content in an environment that offers creativity and credibility.

With this in mind, brands must deliver real value, offering inspiration and delight rather than “just” information.

Known for its influence on purchasing decisions, LRB can showcase student testimonials, campus lifestyle, or product reviews. Engaging content here can significantly impact the decision-making process.

Originally a platform for grey-market buyers and sellers, LRB is now arguably the most popular platform for ‘social shopping’. Chinese users can research, review, flaunt and buy products at home and abroad.

LRB has most recently released small business accounts to compete with WeChat and Douyin, offering cross-border sales options at a fraction of the cost of platforms such as JD and Tmall. Although beauty, skincare, and fashion are still the key topics, RED has become the dominant platform for brands in travel, wellness, education and property, because of its high percentage of affluent users.

Unite Students used Little Red Book to create engaging content featuring their brand, properties, amenities, student experiences, and local attractions.

Using authentic user-generated content and targeted promotions, they connect with Chinese students, tap into trends, and build trust within the community, driving interest and bookings.

Baidu:

Baidu is often described as China’s equivalent of Google, serving as the dominant search engine in the country. Just as universities optimise their websites for Google searches, they can also optimise for Baidu. This involves understanding Baidu’s algorithms and incorporating relevant keywords in the content to ensure better visibility in search results.

Weibo:

The original ‘Social media’ site in China, was once almost wiped out by WeChat.

It made a strong resurgence and offers all of the popular ‘viral’ functionalities a social app could need. Weibo still has 605 million monthly active users. Often likened by Western marketers to an Instagram-Facebook hybrid, it is a unique app that is built for generating mass awareness.

Weibo has 222 million daily active users, with 80% of those under the age of 35.

It boasts a large user base and offers various features like microblogging, multimedia sharing, and community engagement. It also has great search marketing functions and is a go-to channel for monitoring consumer sentiment. Weibo can be a lot more cost-effective for generating impressions than other social platforms.

The unavoidable risk of social media: Managing reputations

How to avoid PR crises, and what to do if one hits.

Open access to publish on the internet brings risks with it, but these risks are there whether you decide to be active on social or not. It could be a rogue social media influencer. Maybe your messaging has gone slightly off-track, or products aren’t meeting expectations.

In general, there are two PR problems that appear in China

1 Mishandling customer complaints

This is one of the most common causes of PR crises. In good news though, it’s also the most avoidable!

To understand what not to do, consider Virgin Atlantic. The airline lost sales and respect in China over time, following a Chinese passenger complaint that wasn’t dealt with promptly. Their grievance went viral on social media and severely damaged the brand’s reputation.

We also mentioned Genki Forest recently in our blog.

Appropriately dealt with, the crisis surrounding packaging claims might have gone away quickly. Instead, the brand angered Chinese consumers with a perceived inauthentic apology on Zhihu, suggesting the brand was unaware of the potential for misunderstanding between “zero cane sugar” and “zero sugar”. Like Virgin Atlantic, this damaged the brand’s reputation and sales across the China market.

2 Cultural insensitivities in Chinese marketing campaigns

You may remember the debacle surrounding Dolce and Gabbana’s China marketing a few years ago. It featured a Chinese woman struggling to eat pizza with chopsticks, the campaign backfired and alienated Chinese and Western consumers alike.

It’s a classic example of brands not understanding cultural sensitivities and actively causing their PR crisis. It’s also the most serious form of crisis because it can lead to boycotts and the inability to regain Chinese consumers’ hearts and minds.

How to prevent or respond to a crisis?

Perform regular social monitoring.

Measuring consumer sentiment regularly is vital. Specialist China marketing agencies can help you monitor sentiment across all your digital channels.

With warning of any potential issues, you’ll have a head-start when putting your “crisis management plan” into action.

Deal with issues immediately

This almost goes without saying, but if you’re dealing with Chinese social media, it’s essential to read and answer all comments and interactions with your brand.

If anything negative crops up, take discussions off public platforms. Instead, see how you can help your consumers through private messaging platforms like WeChat.

Work with a dedicated customer service team in China

Have you ever tried to get a complex problem solved by someone in a call centre halfway around the world? It can be tricky.

Well, Chinese consumers feel the same.

Ensure you have a dedicated customer services team (or person) in China and that they’re contactable via your verified social media channels. WeChat is especially important, so any complaints aren’t voiced in the public sphere.

Create a crisis management plan

Fail to plan, plan to fail.

Create a thorough crisis management plan that covers all your official communication channels and Chinese social media accounts. Reputation management is key, which involves actively controlling your social media accounts as well as investigating and evaluating any issues (as soon as they arise).

Once you’ve understood the problem, follow-up with an appropriate response outlining the steps you’ll take to prevent further negative impact. It might even be possible to turn a negative situation into a positive (for instance with the help of PR agencies or social influencers).

But whatever your strategy, the important thing is planning – before a crisis happens.

Work alongside a specialist Chinese marketing agency

Finally, work with a specialist Chinese marketing agency to write and implement your Chinese marketing campaigns. Whether it’s smaller issues like accurate translations or larger insights into cultural sensitivities (that could have prevented many of the crises above!), you can launch campaigns with confidence.

As well as creating and fine-tuning your Chinese strategy, a dedicated agency can help you gain access to the right influencers and provide in-depth knowledge on the best ways to use Chinese social media platforms.

Building your USP’s

Now we understand the opportunities and risks of the channels, we need to make sure we have a solid foundation in our messaging before we start producing creative.

The temptation is to use the same messaging that appeals to UK students or other international target countries, but the differences in culture and experience that your Chinese students come with mean that this is usually not the message that will appeal to them.

We need to work through:

- The stakeholders we are targeting

- The messages each group will see

- How this differs from your competition

- What proof you have to back up each promise

Identify target stakeholders.

Identifying and understanding who are target stakeholders are is a pivotal step in driving a successful Chinese student recruitment strategy.

Undergraduate (UG) & Postgraduate (PG) Students:

Understanding the preferences, aspirations, and challenges of prospective students is fundamental. Making sure your messaging and engagement strategies match their needs is key to successful recruitment. They’re looking for quality education, a variety of courses, good job prospects, a fun campus life, and a supportive community.

Industry Partners:

Collaborating with industry players can enhance the attractiveness of your educational offerings. Showcasing industry connections, internships, or job placements adds value and appeals to students seeking career prospects.

Chinese students look for institutions fostering talent aligned with industry needs, collaborative opportunities, and a skilled workforce.

Existing Students & Alumni:

Leveraging the experiences and success stories of current students and alumni can significantly influence prospects.

Their testimonials and achievements offer credible insights into the educational experience you provide. In return they look for recognition, networking, and ongoing support from their alma mater.

Parents:

Family plays a crucial role as it often has a strong say in their children’s education and career paths. The family’s financial situation and educational background will impact a student’s decision to study abroad.

To engage Chinese students, acknowledging family influence is crucial. Institutions need strategic approaches that consider both student needs and family concerns.

Agents:

Agents play a pivotal role in facilitating student enrolment and are often thought of as a one-stop shop for student recruitment. Not only are they involved in referring a student and assisting them in the admissions process, but help with issues around housing or financing for study abroad.

Establishing strong relationships with agents, and providing them with compelling content and necessary support, can amplify your recruitment efforts. Agents want reliable educational institutions, incentives, and streamlined processes for effective student placement.

Understanding your target stakeholders’ needs is crucial for successful Chinese student recruitment.

If you align your strategies with what your key stakeholders want, you can create amazing campaigns and build strong relationships, which will help you recruit successfully.

Reaching diverse stakeholders on social channels:

The University of Manchester’s Corporate Campaigns Team aimed to engage Chinese academics and researchers, elevating awareness of their research among these crucial international audiences.

The Emerging Comms team developed a targeted, content and media strategy to tackle this challenge effectively. The strategy focused on tailored content and precise targeting, by utilizing intricate metrics for channel selection and ensuring a swift campaign launch within two weeks.

After comprehensive audience analysis, we curated bespoke China-focused assets, and maximised engagement through video ads on Toutiao/Douyin and banner ads on WeChat. Leveraging niche geographic targeting and over 100 interest/behaviour labels, the campaign was continually optimised based on real-time performance to drive sign-ups to their international newsletter and promote their pioneering research.

University of Manchester drive brand awareness and long-term engagement with Chinese academics and researchers using Douyin.

Build a competitor analysis:

First off, do a thorough competitor analysis to figure out who your rivals are and what strategies they use.

When we assess other institutions, we can see where they excel and where they struggle. To understand how they attract Chinese students, look at their academic programs, cultural activities, and language help. In the end, your competition can help you stand out and connect with Chinese students’ needs and wants.

Discover unique selling points that matter:

What makes you special compared to other competitors? This involves thoroughly understanding your institution’s strengths, research capabilities, innovative programs, cultural diversity, faculty expertise, or industry partnerships. Differentiation should align with what matters most to your prospective students and convey why your institution is the perfect match for their ambitions.

Social listening is another hidden gem that most companies ignore or undervalue. Social listening can not only give you amazing, up-to-date feedback on the best topics, content styles, and campaign hooks to achieve your objectives.

Not only that, but social listening allows you to spot the icebergs before they hit, and address potential issues before they escalate.

It gives you the chance to reward engaged audiences, turn them into brand advocates, and convert missed opportunities. Many businesses could have solved PR crises in China before they started, had social listening been in place.

Take Unite Student’s Chinese New Year Campaign for instance. Unite leveraged the festive period to develop emotional connections with Chinese students to drive accommodation booking for the next academic year.

Initially, we used social monitoring tools to gauge customer sentiment, allowing for real-time responses and helping them to understand the concerns of students around accommodation amidst the pandemic.

This approach provided valuable consumer insights, aiding in addressing critical student needs during those challenging times. Then, Unite Students tailored their outreach to match the concerns of both students and parents, ensuring relevance and resonance.

The campaign involved curated content inspiring individuals on ways to create a homely atmosphere within Unite Student properties.

Through KOL live streaming sessions, they brought the essence of Chinese New Year to life by showcasing cooking sessions, discussing CNY rituals, and engaging in fun games. All this helped to encourage accommodation bookings by bonding with prospective and existing consumers.

Unite Students – Beating acquisition & retention targets, despite the pandemic.

Find Reasons to Believe:

Before delving into student recruitment, identify your university’s core values and what makes it stand out to provide your consumers with a reason to trust your brand over others.

How does your institution resonate with the aspirations and needs of Chinese students? Formulate a clear value proposition highlighting unique offerings, academic excellence, student-centric approach, campus culture, or specialised programs.

Remember that every University will be claiming excellent educational facilities and good job prospects, so what makes you different and how can you prove it?

Managing the student recruitment team

At Emerging Comms, we understand these challenges of team management on two sides of the globe. We facilitate teamwork between China and the rest of the world to create exceptional Chinese marketing campaigns.

One of the most frequent questions our clients have is how to integrate Chinese teams. In response, we offer our key insights. We’ll explain why disconnects occur, as well as how to cultivate the best working dynamics. By shedding light on these challenges, we pave the way for actionable solutions to streamline collaborations and enhance productivity.

Before we look at the best ways to do this, let’s understand why disconnects happen.

Time differences

Differences in time zones pose a considerable challenge, with China ahead of the UK by 7 to 8 hours and up to 13 hours ahead of the US.

This gives little overlap between teams unless you take steps to adjust working hours. If you have teams working across London and Shanghai, when UK staff start at 9 am, it’s already 4 pm in Shanghai!

Luckily, this issue is easy to solve. At Emerging Comms, our UK teams start and finish slightly earlier and our China teams start work later. To create our Chinese marketing campaigns, we also ensure there’s plenty of time for collaborative working. We block out 8-11 am UK time and 4-7 pm in China for staff meetings and discussion. This deliberate scheduling allows for substantial overlap, enabling effective communication and shared progress despite the time zone disparity.

Language barriers

All our staff at Emerging Comms are bilingual to an advanced degree. But don’t underestimate how much gets lost in translation between teams.

While face-to-face interactions allow for the observation of body language, this becomes more challenging during video or conference calls. This is crucial during intricate and innovative discussions concerning China’s strategy.

In online meetings, achieving crystal-clear communication stands as a pivotal factor.

We’ll look at how to do this, but always set specific deadlines and expectations and build interpersonal relationships wherever possible.

Cultural understanding

It’s an all too common scenario, but global headquarters often possess a limited, outdated understanding of Chinese consumer preferences. The COVID-19 pandemic exacerbated this disconnect, as many executives haven’t visited China since 2019, missing critical shifts in consumer behaviours and market dynamics.

So, what can brands do to bridge this knowledge gap?

Active listening to your Chinese colleagues is essential. From Chinese marketing services and sales teams to third-party agents and distributors, these are the people with their feet on the ground, talking directly to Chinese consumers.

Whether it’s Chinese social media trends or cultural developments, things move incredibly quickly in China. Listening, learning and transforming these insights into agile business strategies.

Staff isolation

In many instances, international corporations maintain a skeletal staff presence in China, limited to just one or two employees. While this setup might make sense financially, it often results in a sense of loneliness and isolation for the individuals stationed there.

These people are typically sales professionals, distributors or agents, working in roles that thrive on networking. Not only from a personal perspective, but also for business profits, it pays to stay connected.

Regular communication is vital, prioritising face-to-face chats on video calls wherever possible. Attend and support any key events in China too, so your staff feel truly valued.

A mere once-a-month check-in call just won’t cut it!

Brand dilution

Protecting and championing brand guidelines can be tricky in any organisation, let alone working across multiple territories.

To keep everything consistent, take a “g-localised” approach. Ask your China marketing colleagues to create localised China branding guidelines aligning with your global mission and identity. Then apply these guidelines to all internal and external communications for a unified brand presence.

Brand dilution happens more frequently on informal channels like WeChat, at in-person events and sales collateral. Each interaction with customers holds immense value, making it crucial to monitor these touchpoints closely.

Managing teams: top tips for getting the most from your staff

Now we’ve explored the issues facing teams working between China and the rest of the world – it’s time to ensure this relationship is the best it can be.

So, what should you do when managing Chinese staff? Let’s delve into effective strategies to maximise your team’s potential and streamline operations across borders.

Working habits in China

Workplace practices vary across different regions, and understanding the nuances in working habits is pivotal, especially when managing international teams.

In UK and US offices, email remains the primary mode of communication within offices. However, WeChat is the norm in China, although using email for company-wide formal communications is acceptable.

Equally, while you might expect the occasional Zoom meet-up in the UK, this isn’t the case in China. Chinese workforces use video or WeChat video calls to connect on a regular basis.

Staying aware of these cultural intricacies becomes indispensable when managing Chinese teams. Adapting to their preferred modes of communication not only streamlines interactions but also enhances the rapport and efficiency within the team.

Setting clear deadlines

It’s a good rule for any business relationship, but especially important in the China market.

Always set clear deadlines, outlining what you expect and by when. This will improve collaboration and communication, especially if your colleague’s English isn’t 100% fluent.

Always be patient and listen to your staff. Ask about their personal lives and actively respond to any work-related concerns. Building personal relationships is an integral part of business success in China – and shouldn’t be underestimated.

Cultural awareness and festivals

As a final tip for managing Chinese teams. Be aware of key China festivals. When appropriate, send gifts to your Chinese colleagues and customers, demonstrating respect for their traditions and fostering strong relationships.

It’s important to understand how traditional Chinese holidays impact working hours. For instance, businesses and factories might close for some of the most important festivals such as Chinese New Year, Labour Day, Tomb Sweeping Day or Mid-Autumn Festival.

This is all about not just translating from global HQ – but “localising” your working habits for the China market.

In addition to festivals, prioritise getting the company together at annual conferences and away days. Team building is essential for geographically remote teams and helps create those all-important personal relationships.

Effectively managing sales agents and third parties in the Chinese market

For many international brands operating in China, sales agents and dealers are essential for building China branding and securing sales.

These agents often represent multiple brands, so you’ll only beat the competition if your products, services and China marketing enthuse Chinese consumers.

To stand out from the crowd:

- Work alongside a specialist China marketing agency to promote your brand in China. They’ll create clear brand differentiation and culturally sensitive marketing materials.

- When partnering with Chinese marketing services, conduct thorough due diligence to ensure credibility and experience this will establish reliable and high-quality collaborations.

- Once you’ve created China-specific marketing, send these updated materials to your agents. Focus on supporting your China agents rather than battling them – they’re the people on the ground and the true experts on Chinese consumers.

- Treat your agents as an extension of your internal sales team and ensure they work closely with your China marketing agency. China agents can assist marketing teams with information on consumers’ wants and desires. In turn, marketers support agents with materials and communications. It’s a win-win.

- Don’t forget personal relationships with sales agents and third parties. These interactions are the heart of business in China, fostered by gift-giving, invites to company parties and cultural awareness. Things like Feng Shui and symbols of good luck remain essential and appreciated by Chinese staff.

By implementing these strategies and nurturing robust relationships with intermediaries and sales agents, international brands can effectively navigate and thrive in the intricate landscape of the Chinese market.

Next Steps

We appreciate that this is a lot to take in if you’re tackling Chinese recruitment for the first time, or if you’re struggling to meet your targets with your existing strategies.

It is important to establish the foundations and have a good understanding of where your institution stands within the market for Chinese students.

Emerging Comms have this as the first step of any successful campaign, and we’ve got access to research data to help make these decisions.

If you’d like to talk about taking the first step towards a more successful Chinese student recruitment campaign, get in touch and we can walk you through the process and how we’ve put it in place for multiple universities.